Payroll management can quickly become overwhelming. Missed deadlines, tax filing errors, and endless spreadsheets can turn what should be a straightforward task into a frustrating experience. Zoho Payroll is designed to take the hassle out of payroll, helping businesses stay on top of payments, tax compliance, and employee records without the stress.

In this blog, we’ll explore how Zoho Payroll makes payroll management easier, allowing businesses to save time and focus on their employees.

Zoho Payroll is a cloud-based payroll software that automates and simplifies payroll processing. Whether you manage a small team or a large workforce, Zoho Payroll ensures accurate and timely payments while handling tax calculations and compliance requirements.

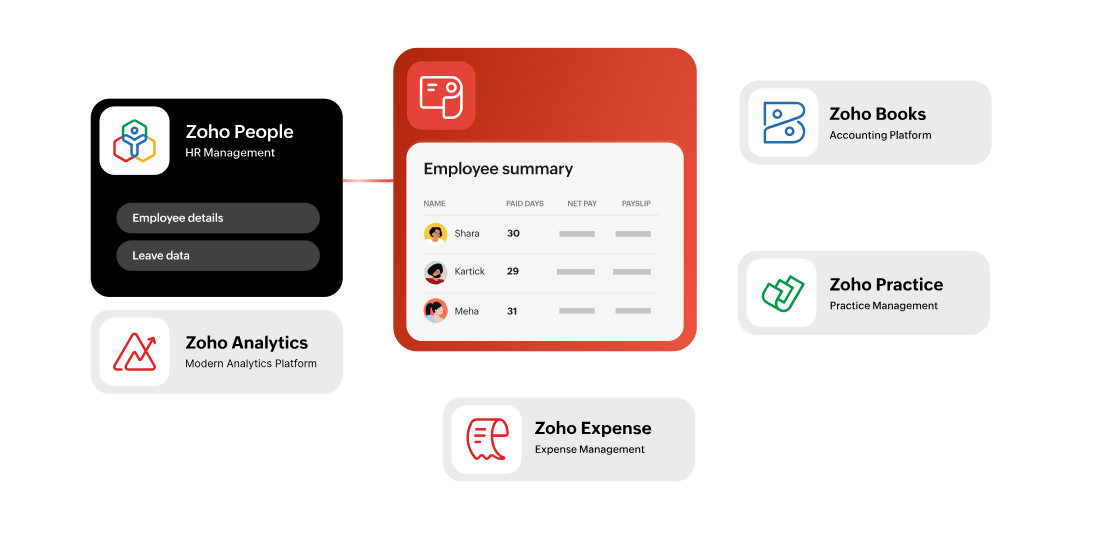

Beyond payroll processing, it integrates with other Zoho apps like Zoho Books and Zoho People, creating a connected system for HR and finance tasks.

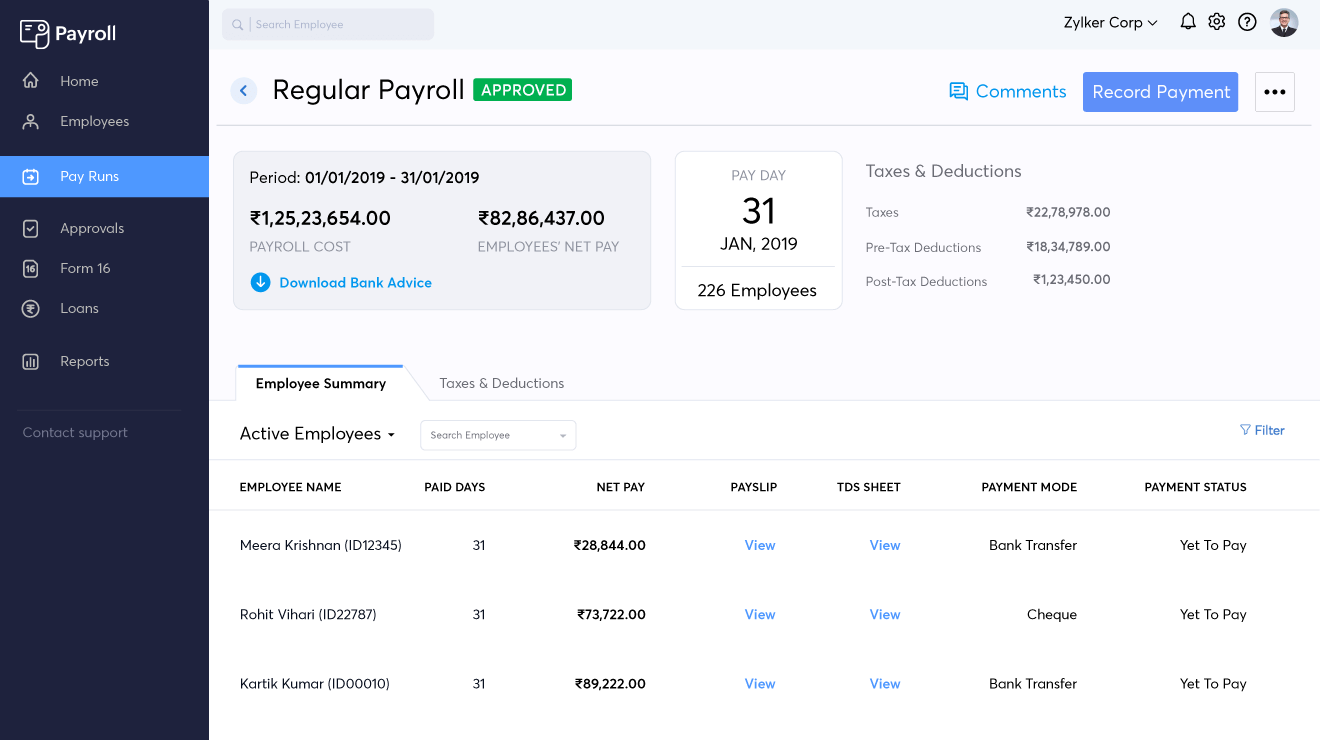

Say goodbye to manual calculations and spreadsheets. Zoho Payroll takes care of salary calculations, including overtime, bonuses, and deductions, reducing the chances of errors. Once you set up payroll rules, the system handles the rest, ensuring accurate and timely payments.

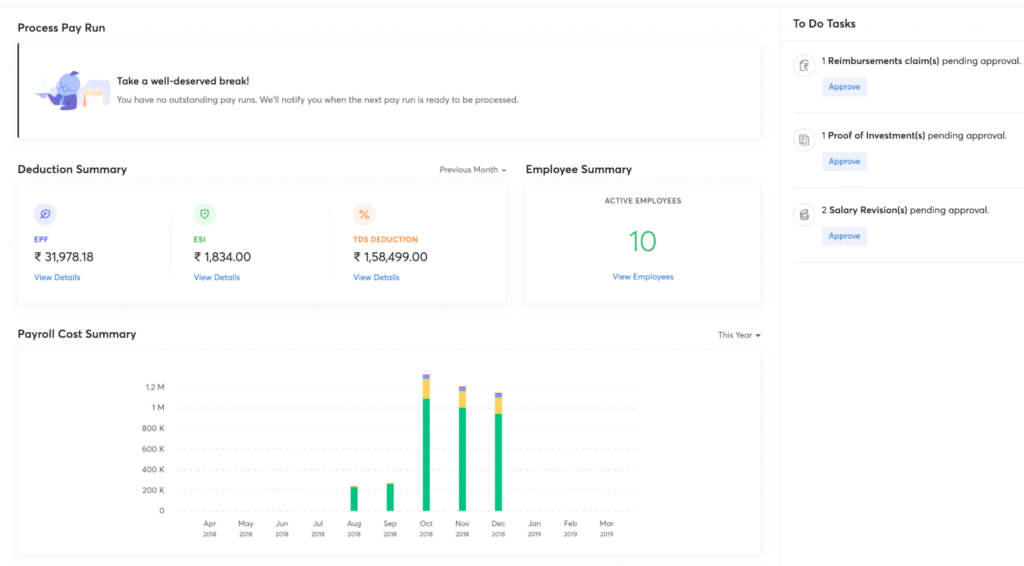

Keeping up with tax regulations can be confusing and time-consuming. Zoho Payroll automatically calculates taxes, generates reports, and helps with tax filing, so you don’t have to worry about missing deadlines or making costly mistakes.

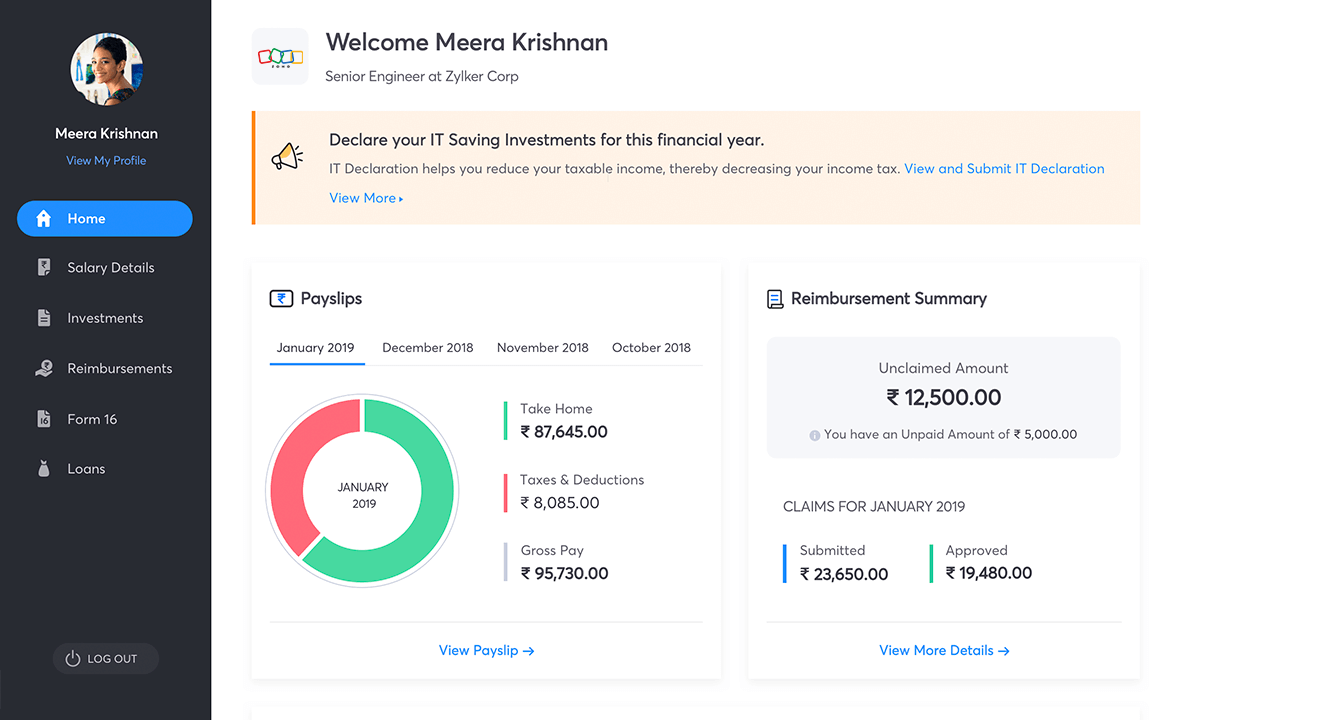

Give employees access to their payroll information through a self-service portal. They can download payslips, update personal details, and access tax forms without needing HR assistance. This helps employees stay informed while reducing the workload for HR teams.

Zoho Payroll works well with other Zoho apps like Zoho Books for accounting and Zoho People for HR management. This means payroll data is automatically synced, reducing duplicate data entry and improving accuracy across departments.

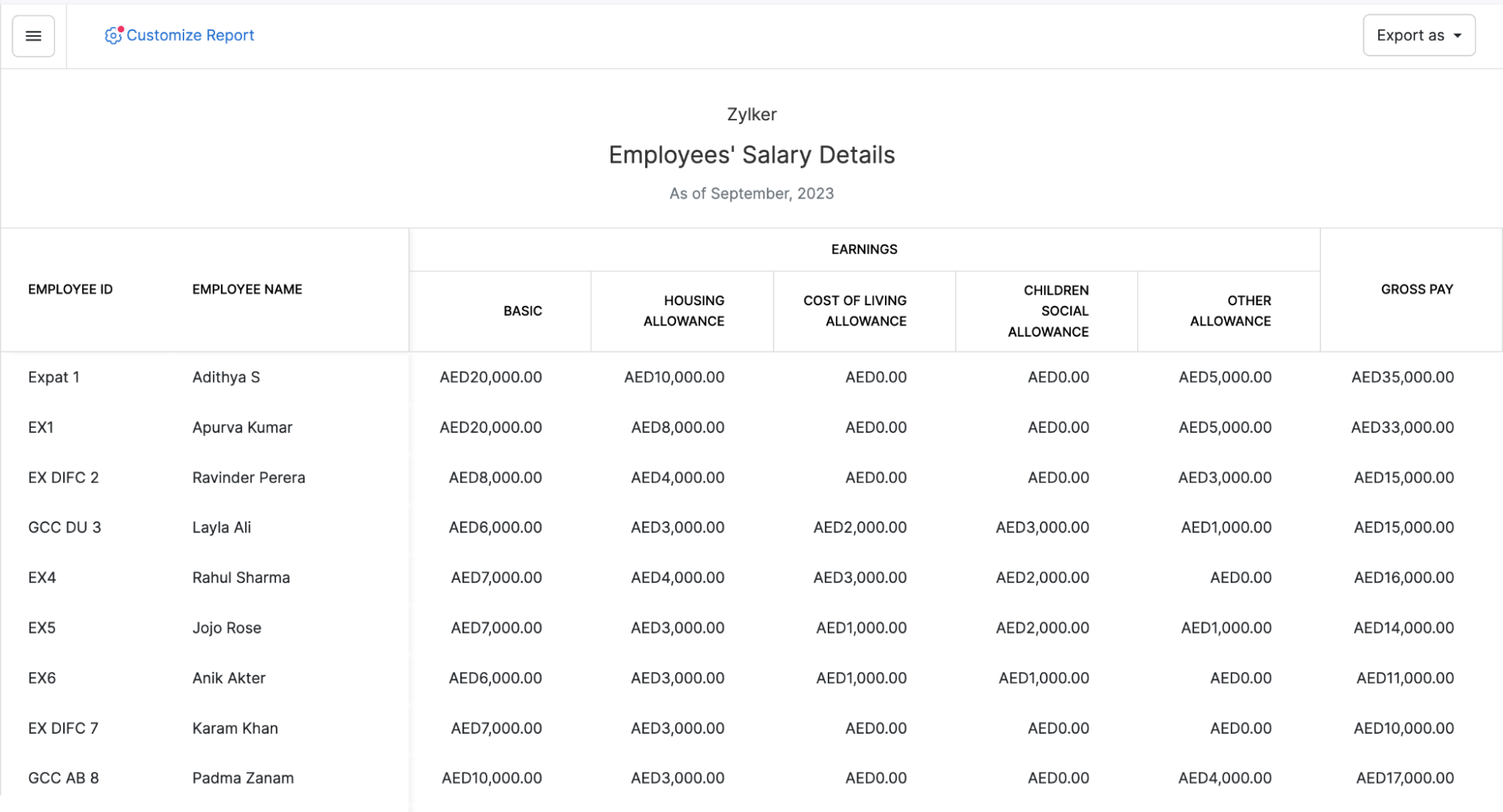

Zoho Payroll provides detailed reports and analytics, allowing businesses to track payroll costs, monitor tax liabilities, and generate compliance reports in just a few clicks.

For businesses with employees in different locations, Zoho Payroll supports multi-country payroll processing. It ensures compliance with local tax laws, making payroll management easier across multiple regions.

Payroll management doesn’t have to be a source of stress. With Zoho Payroll, you can automate tedious tasks, ensure compliance, and focus on what truly matters, building a thriving business and a happy workforce.